About the report

Produced

06 July 2023

Written by:

Themes

People challenges

DownloadClick each term for related articles

Introduction

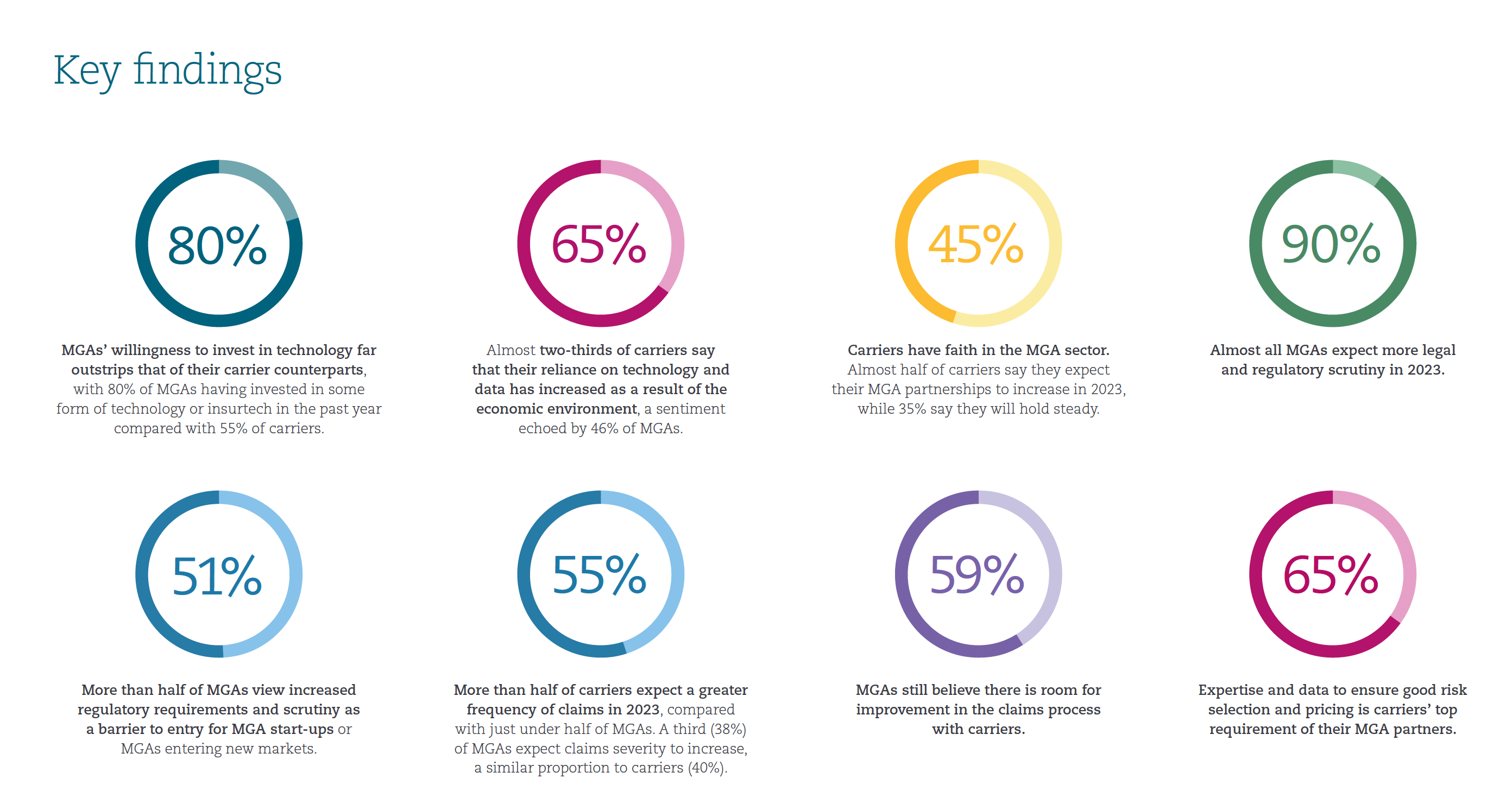

Despite the economic turbulence of the past few months, confidence in the MGA sector remains high. Our survey findings and conversations with industry insiders highlighted a definite sense that the future for MGAs remains bright.

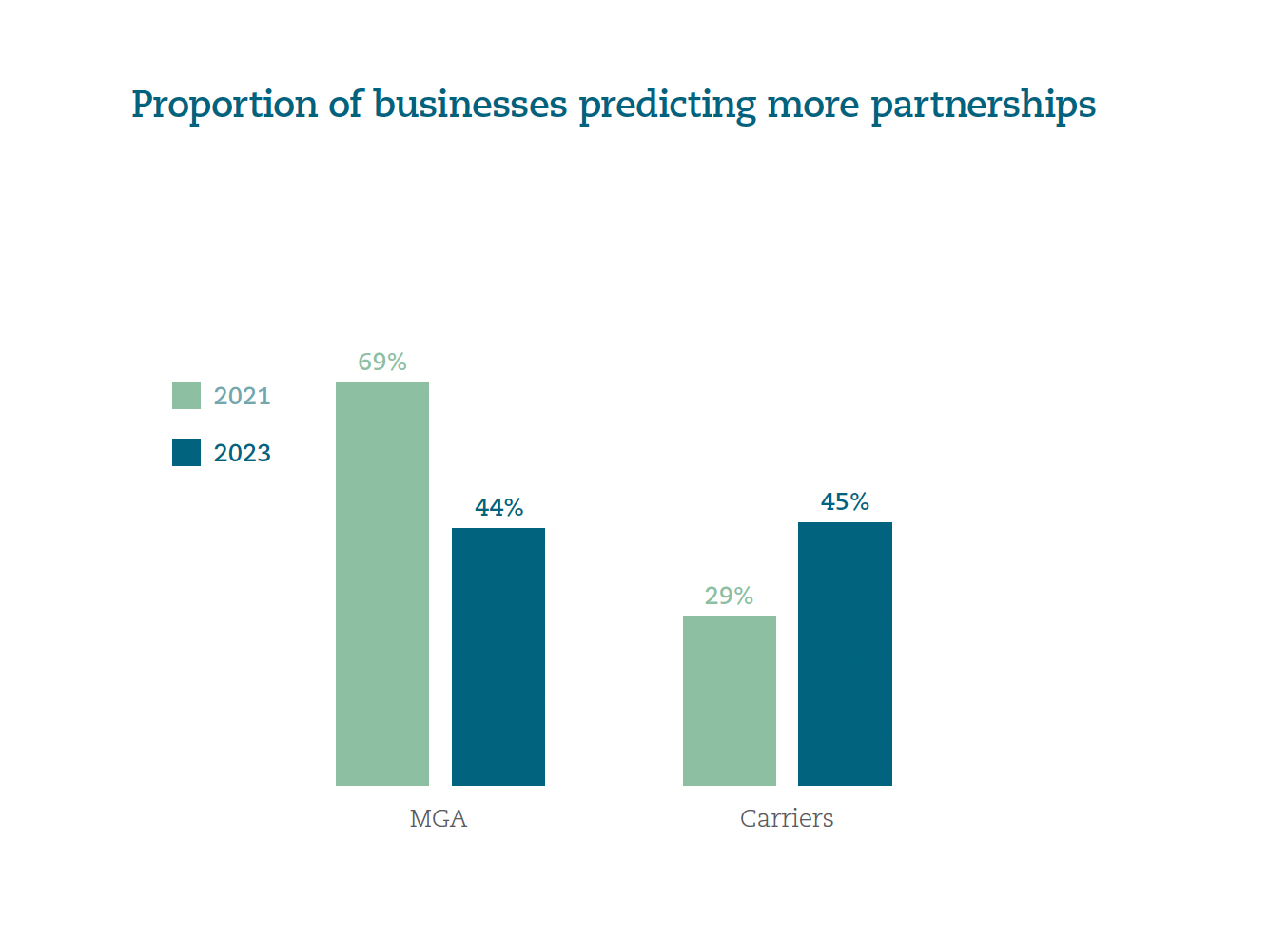

While 45% of carriers said they would increase their MGA partnerships in 2023, a further 35% said their partnership involvement would hold steady. MGAs too believed overwhelmingly that partnerships would hold steady or increase.

Carriers are keen to be involved with MGAs as they grow, the results are there. Carriers have seen positive returns via MGAs while feeling like their hand is still on the wheel.

Carolena Gordon, Senior Partner

There’s a maturity in the MGA space, a recognition on the part of carriers that MGAs can offer access to expertise and tech and to the development of new, innovative and flexible products.

Rob Crossingham, Partner

As MGAs mature and gain scale, they add to their tool kit the opportunity to speak to more diverse capital providers, such as insurance-linked security funds, for example. There is some appetite among MGAs to explore using their own, or alternative sources of capital, which reflects an increasing maturity in the sector, according to experts.

The economic situation has increased the focus of carriers on wordings and accelerated a reliance on technology and data, while both carriers and MGAs reported a broadly neutral effect on capacity allocation.

Still, the majority of respondents said that the economic environment thus far had not had a material impact on carriers’ capacity allocation to MGAs. Some 55% of carriers and 59% of MGAs said the economic environment had had a neutral effect on capital allocation in 2022.

Carriers and MGAs indicated strong interest in growing overseas, particularly in Europe.

Eva-Maria Barbosa

MGAs and carriers appear united that regulatory scrutiny will increase over the coming 12 months. And while this comes with an increased cost and compliance burden, most practitioners acknowledged that increased oversight was improving standards and behaviours and consumer trust in the sector.

I think that regulation is a much bigger barrier to starting up an MGA than it was even a year ago. The FCA and the PRA (through carrier oversight) are requiring MGAs to provide much more information than ever before. That being said, there’s no doubt that increased regulation has improved behaviours overall.

Charles Manchester, Chairman, MGAA

A shortage of talent or expertise appears to be an emerging issue for the sector, with both MGAs and carriers citing it as one of the top three barriers to entry for MGAs starting up or entering new markets.

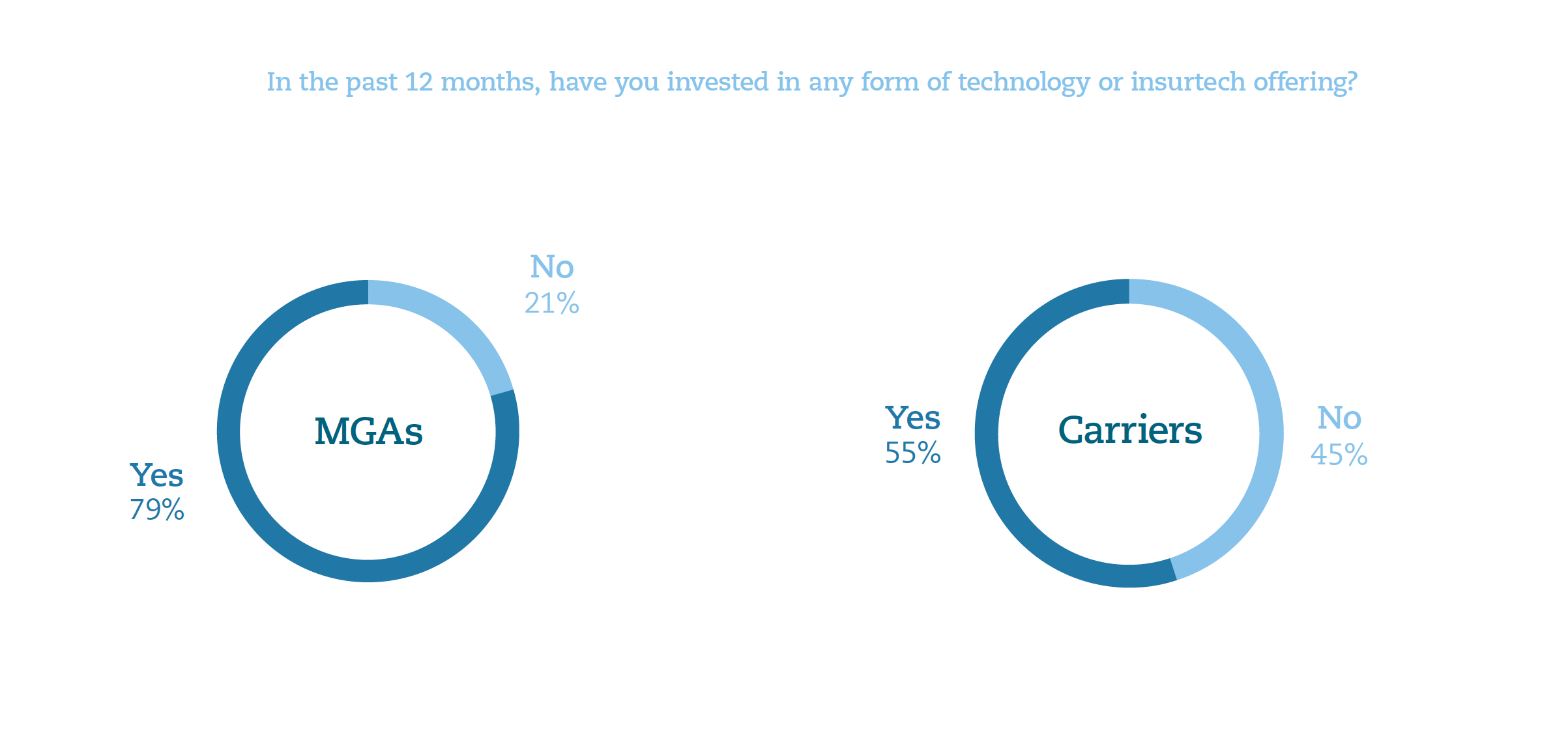

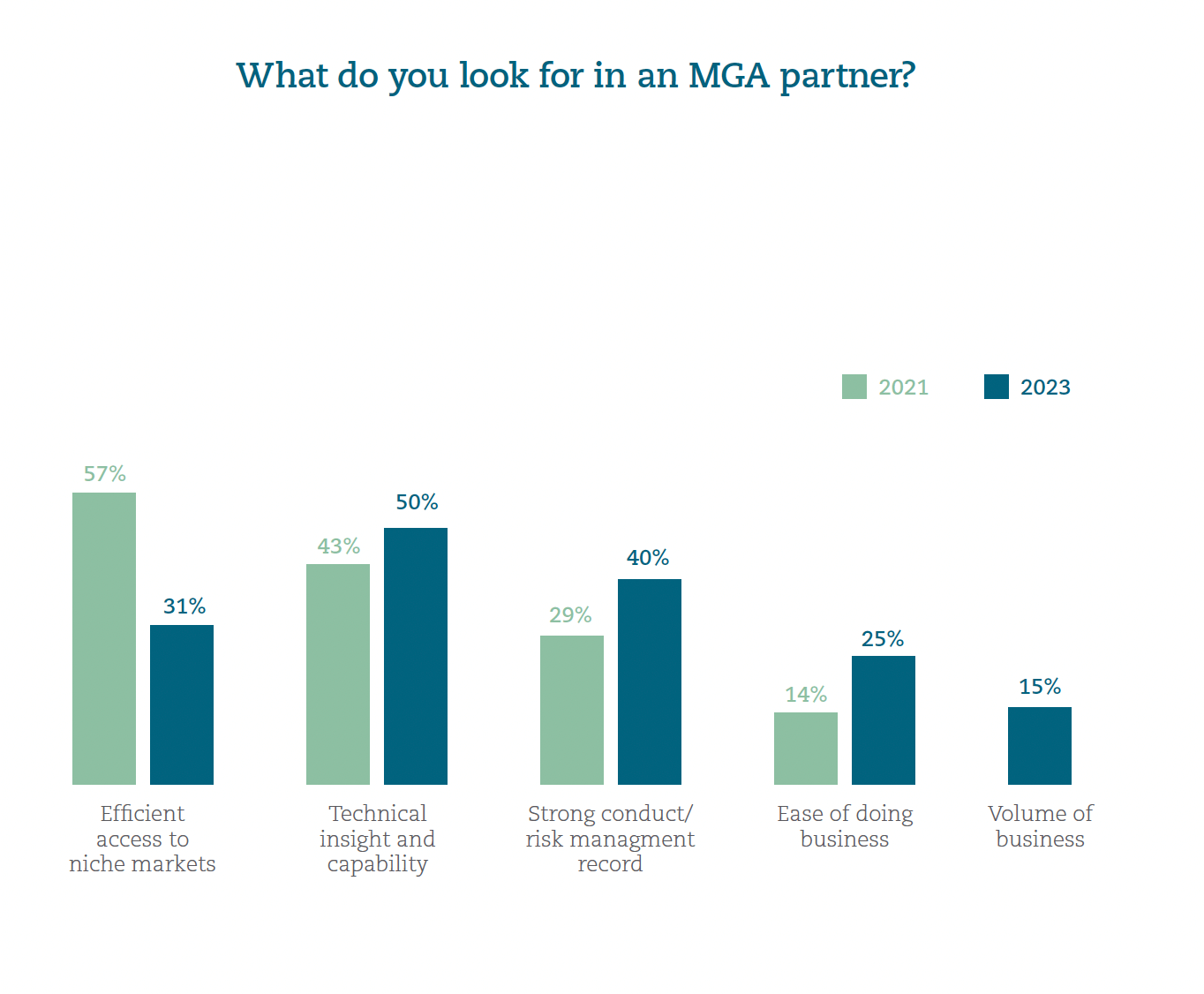

Carriers clearly signalled that expertise, data and technical expertise were key factors they looked for in MGA partners. They strongly underlined MGAs’ ability to use data and tech to empower good risk selection as a top priority. MGAs have invested in data and tech, the survey showed, and this investment is likely to be bearing fruit as their models evolve.

Investment in tech and data is clearly a priority for those MGAs that want to attract capacity and build good carrier relationships.

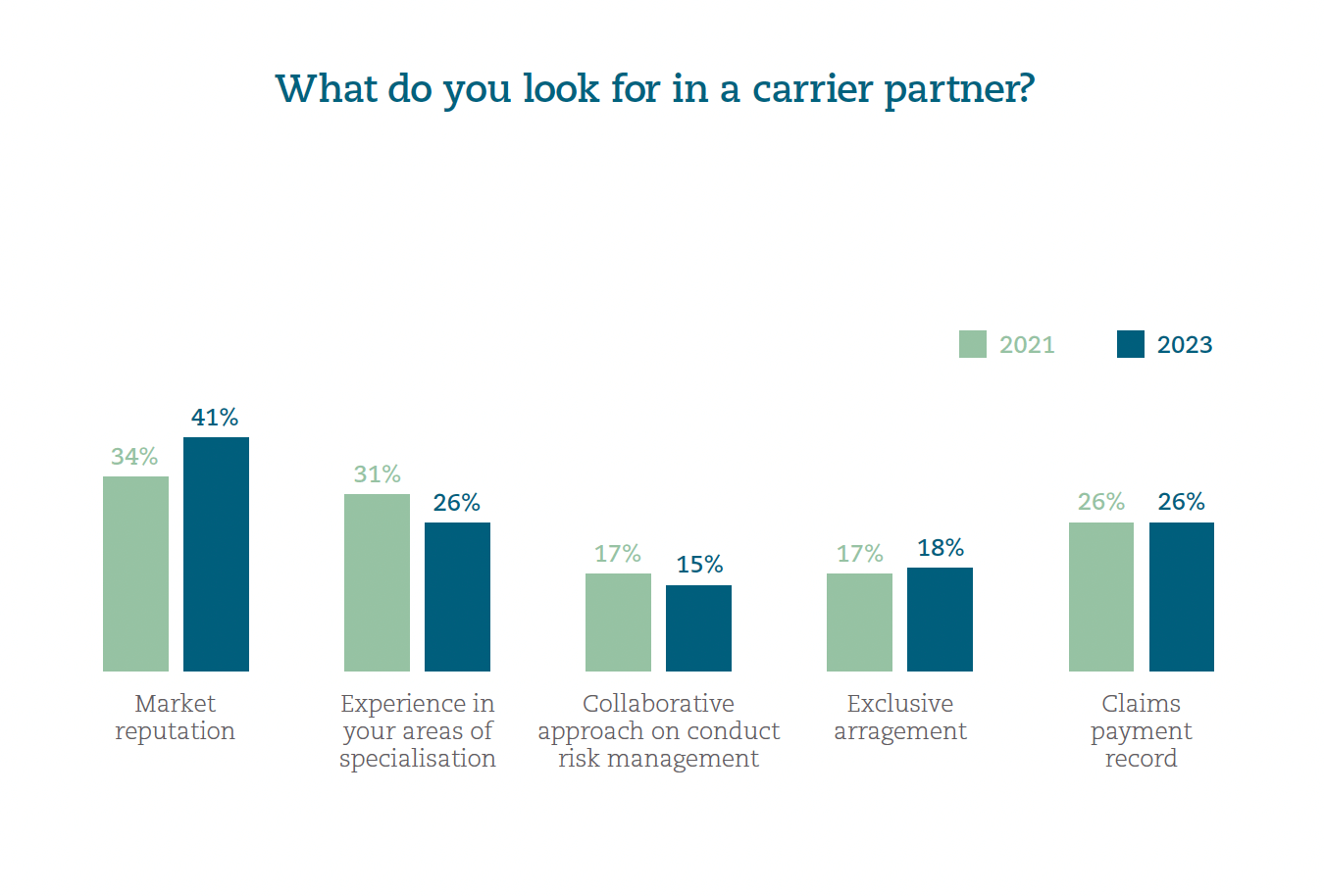

MGAs cited capacity stability and longevity as the top priority in carrier partnerships, as they did in the similar study carried out two years ago. For MGAs, this desire for stability and longevity in partnerships is not new and is the natural top priority, experts said.

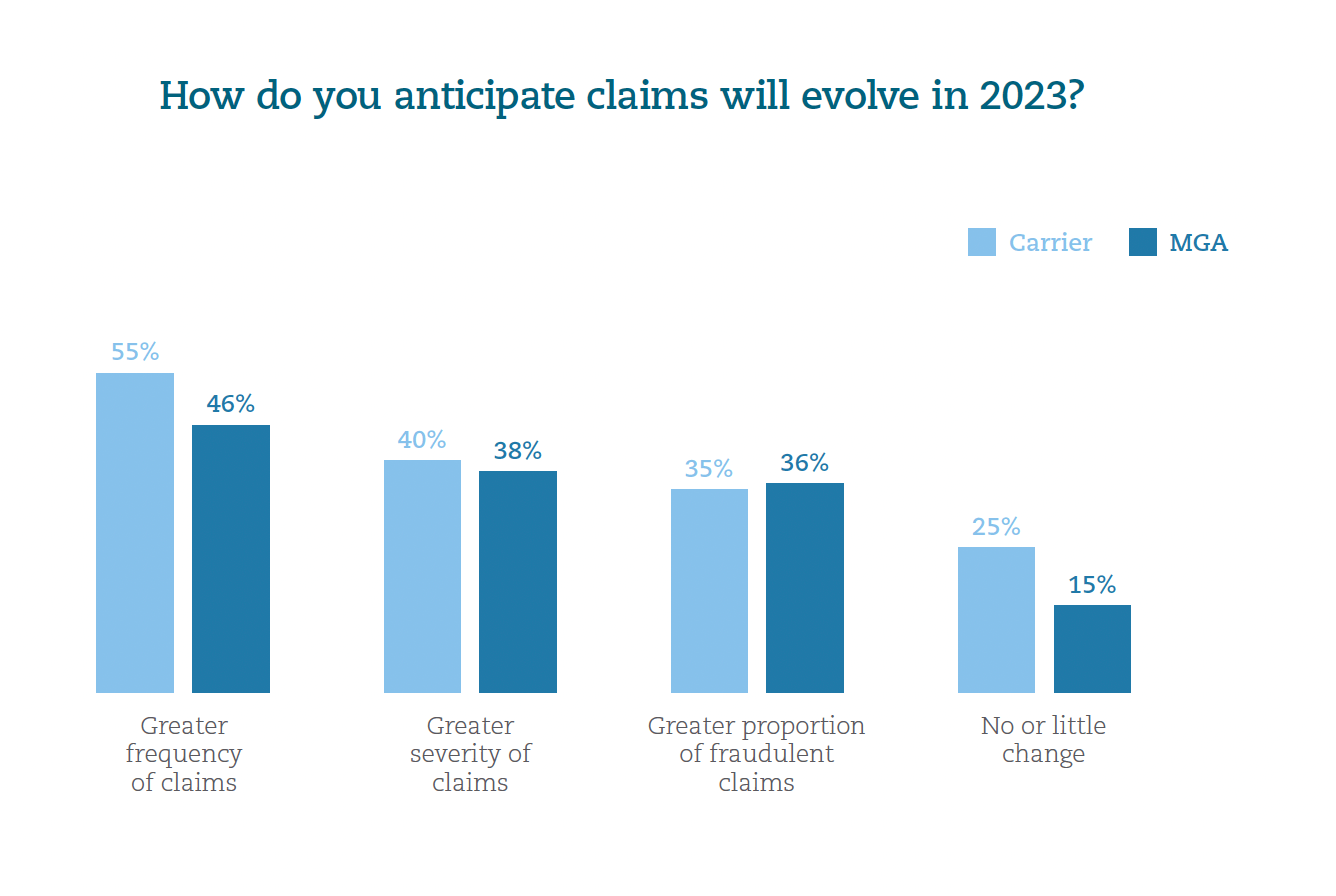

As the effects of worsened economic conditions are felt in the UK, there is an expectation that the frequency of claims will increase. While the shadow of COVID-related claims has receded somewhat, economic stress coupled with the resumption of activity in sectors that were adversely affected by the pandemic, coupled with societal changes, are likely to lead to an uptick in claims volume over the coming year.

We are seeing more claims come in, possibly because of a mixture of the fact that people are now moving about more than during the pandemic, and possibly because of worsening economic conditions for many.

Henry Kirkup

Michael Payton, Chairman

End