Insurance M&A activity at lowest level for a decade

-

Press Releases 27 February 2024 27 February 2024

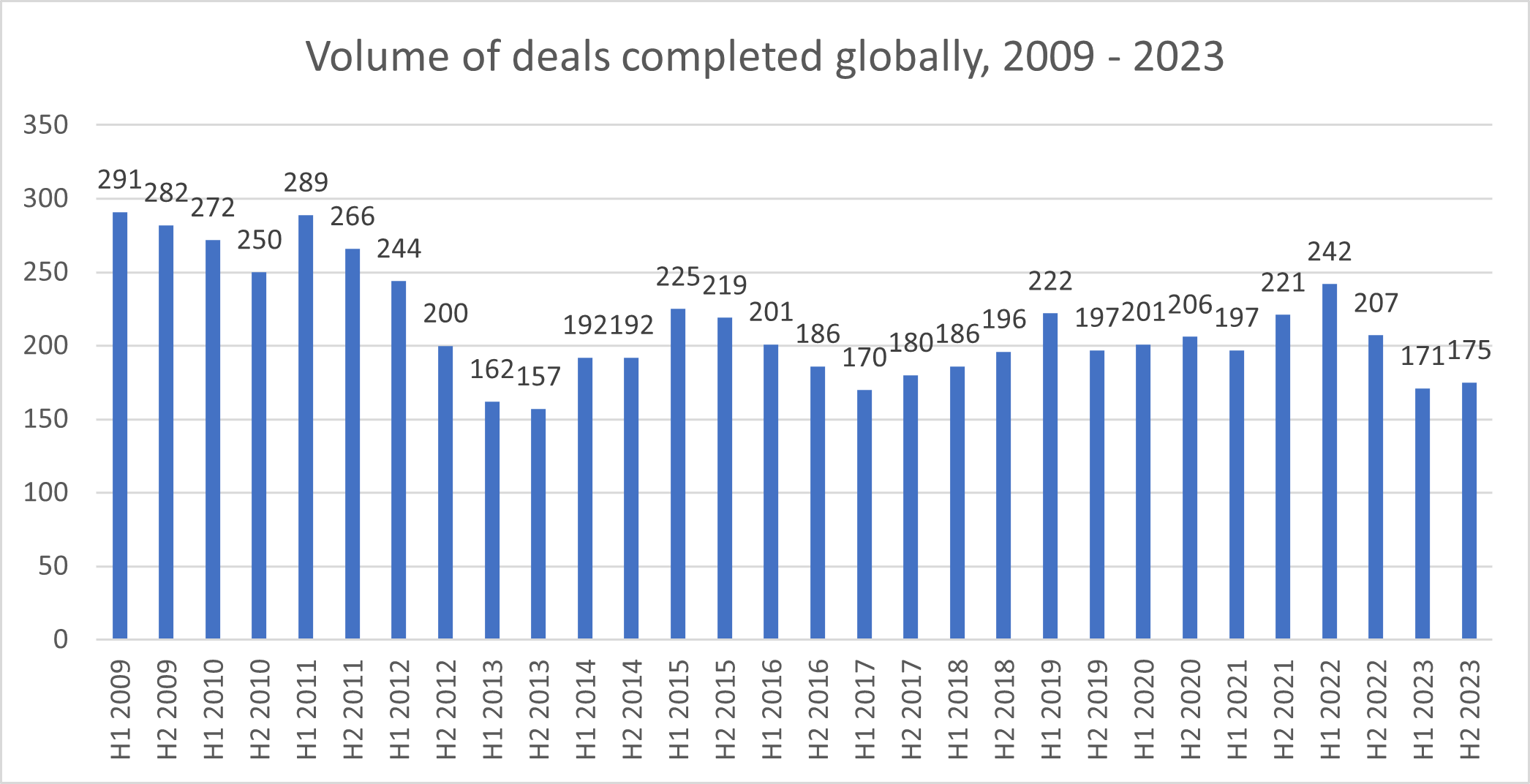

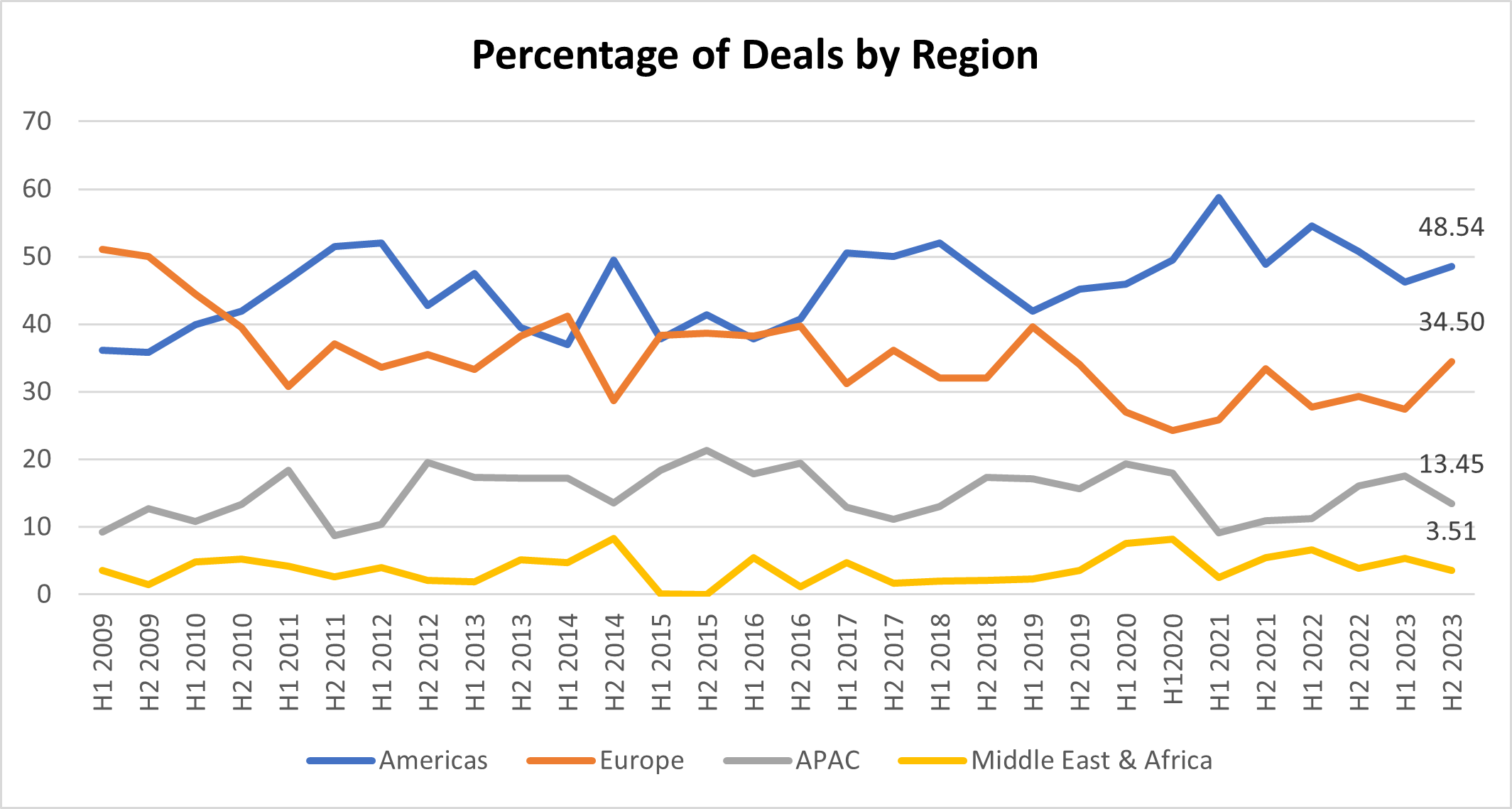

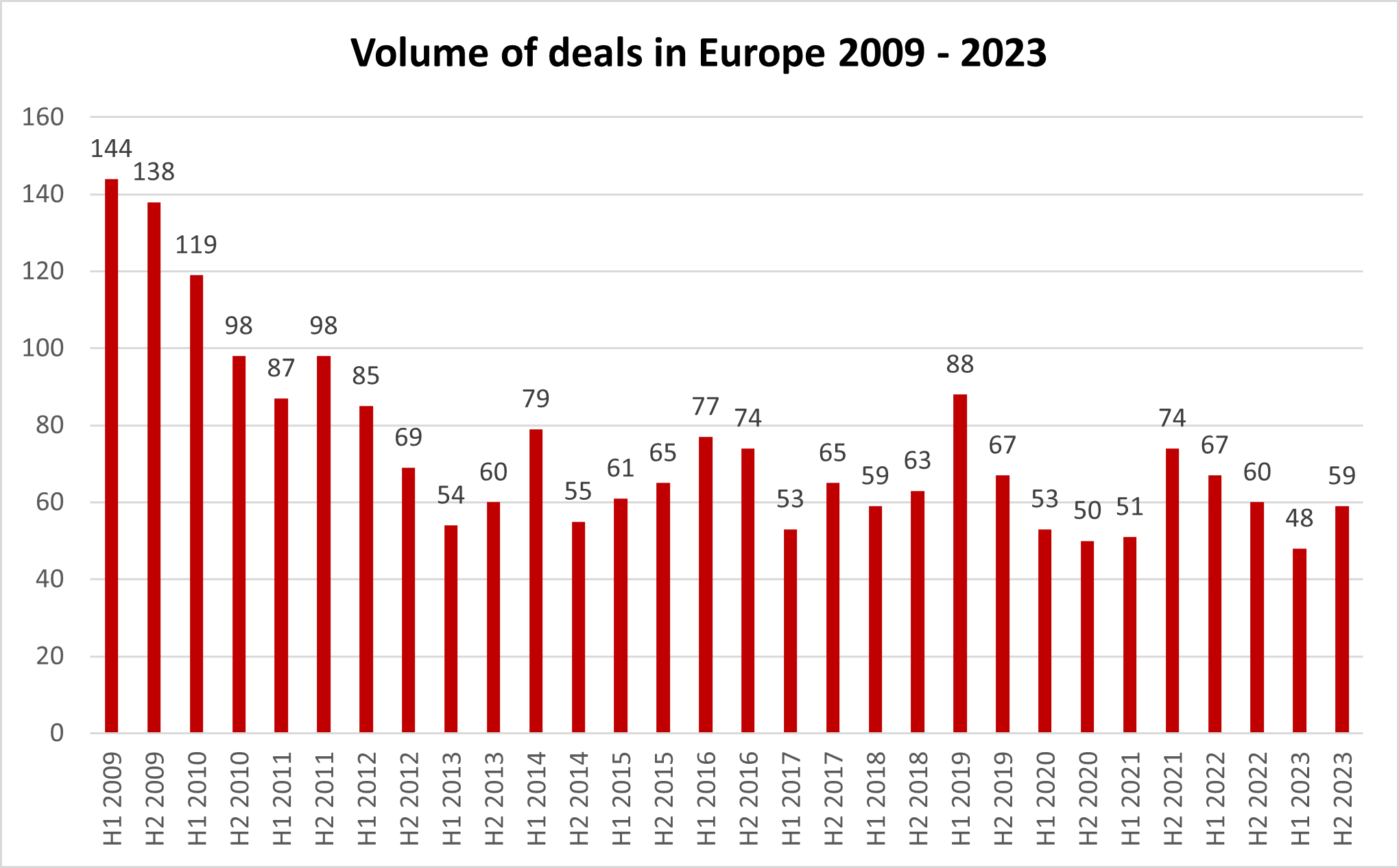

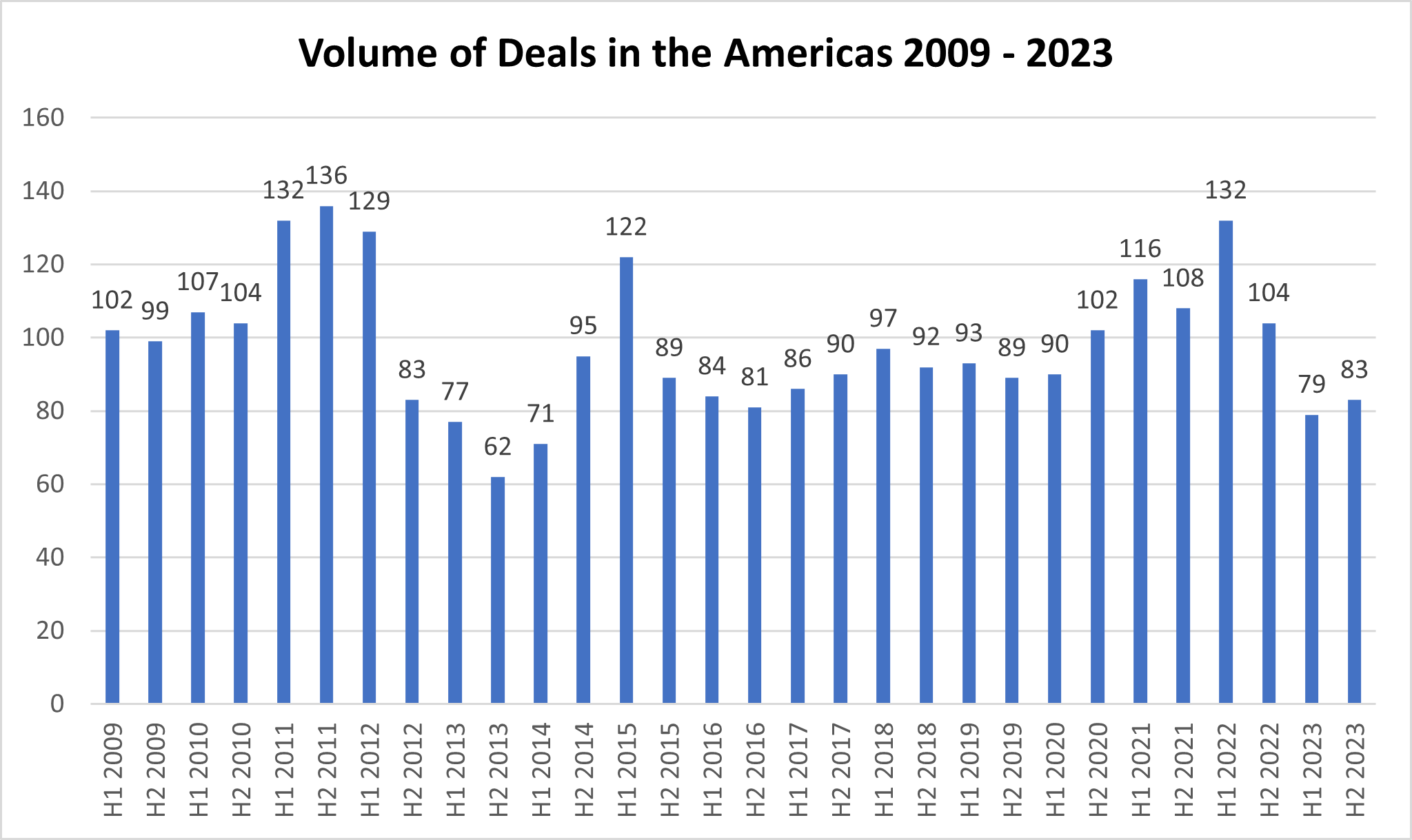

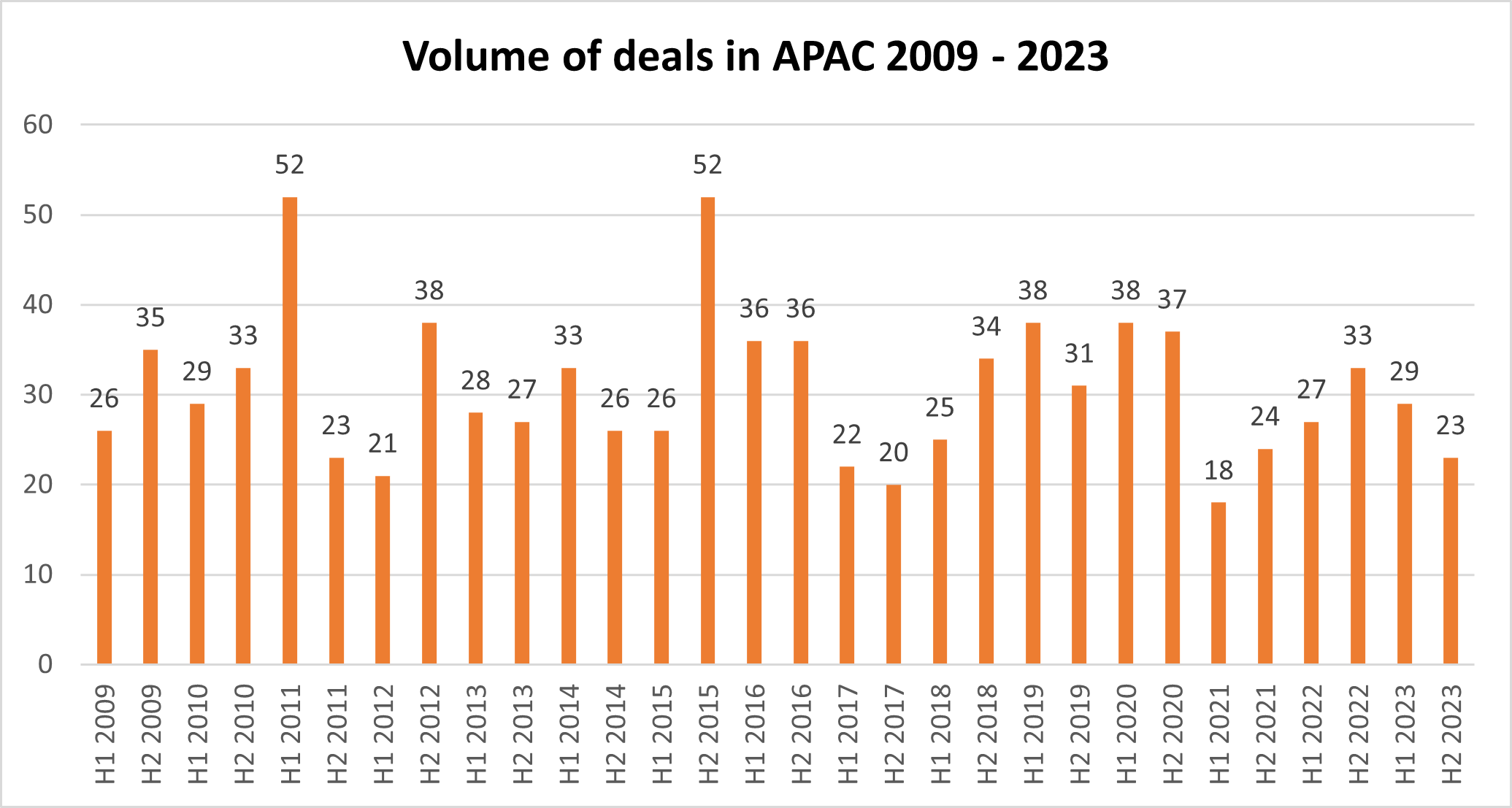

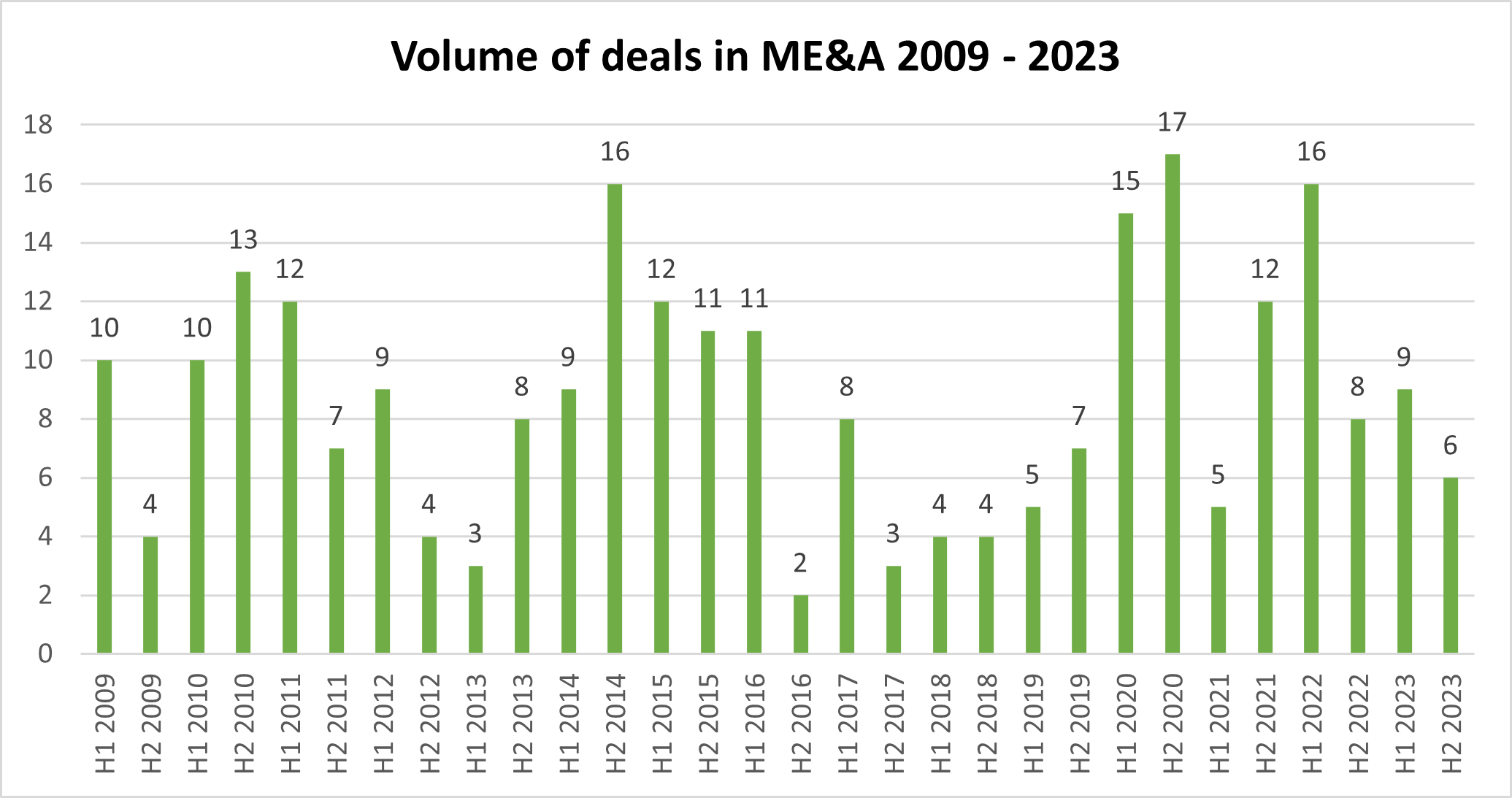

There were 346 completed mergers and acquisitions (M&A) worldwide in the insurance sector in 2023, down from 449 in the previous year. Year-on-year activity was down across the globe, with each of the four regions dropping, by between 37.5% (Middle East and Africa) and 13.3% (Asia Pacific). These findings are from the latest edition of global law firm Clyde & Co’s Insurance Growth Report, which was released today.

Completed deals down across the globe in 2023

Companies react cautiously to geopolitical and macroeconomic uncertainty

Second half of the year raises hopes of Europe-led rebound

Insurers pursue organic growth alternatives including cyber, W&I and crypto

Peter Hodgins, Clyde & Co Partner in Dubai, said: “As the global economy continues to feel the impacts of high inflation, funding for transactions for many insurance businesses has been challenging to find. Meanwhile, with over half of the global population expected to be called to the polls in 2024, as well as a number of escalating regional conflicts, heightened geopolitical risks have become a persistent concern. In the face of this market uncertainty, deal-makers have remained in wait-and-see mode, with a negative impact on overall transaction volume in 2023.”

The Americas remained the most active region for M&A – but the distance to second-placed Europe narrowed significantly in 2023, down to just 55 deals from 106 in 2022. The downward trend exhibited by Europe and the Americas in the first half of the year was reversed in the second half, as the number of deals increased. The Americas saw a modest increase of 5.1%, with Europe leading the revival with a 22.9% increase compared to the first half of the year. The opposite was true for the Asia Pacific and Middle East and Africa regions, that saw 20.7% and 33.3% decreases in activity in H2 2023.

Europe to lead insurance M&A rebound in 2024

Europe’s uptick in deal activity in the second half of 2023, combined with the expectation that central banks will cut interest rates later this year, is raising hopes that 2024 will see a return to the higher levels of M&A enjoyed in the years preceding 2022.

International carriers and MGAs which previously withdrew primary capacity from other regions are now looking to deploy their capital elsewhere.

Eva-Maria Barbosa, Clyde & Co Partner in Munich, said: “M&A activity is coming back to the European insurance market, as leading global carriers look to acquire specific business lines – particularly those high volume, but relatively low premium contracts that can be sold as embedded or affinity products. Companies finding it challenging to achieve healthy margins on commercial business are looking for reliable cash flow in the personal lines space.”

Opportunity in geopolitical risk

2023 will be a year dominated by geopolitical risks, with evolving regional conflicts in Europe and the Middle East and Africa, along with elections in the US, UK and further afield. This may cause insurance businesses either to rein in expansion plans or pull back from lines of business or territories impacted by conflict.

However, businesses will need support from insurers as they navigate this risk backdrop and its impacts on their supply chains and foreign assets located in and around conflict zones.

Peter Hodgins, Clyde & Co Partner in Dubai, said: “There is an important role to be played by insurers as businesses get to grips with evolving geopolitical risks. The Middle East has already seen significant events such as the Israel-Hamas conflict and tensions around the Red Sea driving up demand for cover of political risks and products like trade credit insurance as clients’ exposure increases.”

Digital assets attracting attention

Insurance businesses continue to pursue alternatives to growth beyond a merger or acquisition. The revolution in digital assets and the use of cryptocurrencies presents a significant opportunity for insurers, with a range of coverages already being written to cover the risks of trading in digital assets.

Liam Hennessy, Clyde & Co Partner, Brisbane said: “Digital assets are on a very fast trajectory globally and we're seeing great demand for them, and the underlying technology On the commercial side it presents a massive opportunity and some major Lloyd's insurers are starting to underwrite D&O, corporate crime, and professional indemnity risks on behalf of asset managers who are advising clients on diversifying their portfolios with exposure to this asset class. Even more exciting, we are seeing insurers adopt blockchain technology in their own businesses for example in loyalty programs, information storage and parametric smart contracts for simple claims.”

Outlook of cautious optimism

We believe deal activity has reached the bottom of this current cycle and will start to increase through 2024, with Europe leading the way. In the US, larger broking players are looking to make acquisitions in both the MGA and broking spaces, while cross-border transactions by intermediaries are also on the move. Elsewhere, international interest in the GCC region is returning, with international brokers looking to acquire businesses in the UAE and Saudi Arabia.

Peter Hodgins, Clyde & Co Partner in Dubai, said: “With financial markets potentially looking more volatile this year, growth in carriers’ investment portfolios is by no means certain. Continuing high interest rates will also impact the cost of debt funding for acquisitions and contribute to increased claims costs and higher operational costs. However, in the face of macroeconomic and geopolitical uncertainty insurers are increasingly viewing the current trading environment as ‘the new normal’ and we expect them to become less cautious with regards to M&A over the coming 12 months.”

Change in deal numbers between whole year 2022 and whole year 2023 by region

|

Region |

2022 |

2023 |

% change |

|

Global |

449 |

346 |

-22.9% |

|

Americas |

236 |

162 |

-31.4% |

|

Europe |

127 |

107 |

-15.7% |

|

APAC |

60 |

52 |

-13.3% |

|

ME&A |

24 |

15 |

-37.5% |

Change in deal numbers between H1'23 and H2'23 by region

|

Region |

H1’23 |

H2’23 |

% change |

|

Global |

171 |

175 |

+2.3% |

|

Americas |

79 |

83 |

+5.1% |

|

Europe |

48 |

59 |

+22.9% |

|

APAC |

29 |

23 |

-20.7% |

|

ME&A |

9 |

6 |

-33.3% |

End